AI Agents and the Transformation of the Financial Industry

Insight | 2025-04-18

16 minute read

Over the past two years since the emergence of large language models (LLMs) as the foundation for generative AI, the pace of progress has accelerated rapidly. In particular, AI agents capable of autonomously executing tasks based on generative AI have garnered increasing attention. These autonomous AI agents integrate generative AI with traditional AI technologies, offering flexible and advanced capabilities. As a result, AI agents can now handle complex tasks and meet a wide range of user needs.

On the other hand, the financial sector has a strong affinity with AI in both tasks that require language processing and tasks that involve data processing, such as analyzing vast amounts of transaction data. Currently, the financial services industry, which continues to undergo transformation through AI, is entering an era of change defined not just by generative AI, but also by AI agents.

This article will explore the structure and functionality of AI agents, examining their impact on the financial industry and how human-AI agent collaboration is shaping the future of financial services.

1.What are AI agents?

There are various definitions of AI agents, but simply put, an AI agent is a digital system capable of interacting independently within a dynamic environment. While such systems existed even before the advent of large language models (LLMs), AI agent systems based on generative AI (LLM-based) can understand given goals and contexts, create their own action plans, and use online tools and data to complete tasks. Furthermore, these agents can collaborate with other agents and humans, learn, and improve their performance through memory. In other words, AI agents consist of not only LLMs but also components such as database access, API integration, rule-based engines (traditional AI), and interfaces with external systems(1).

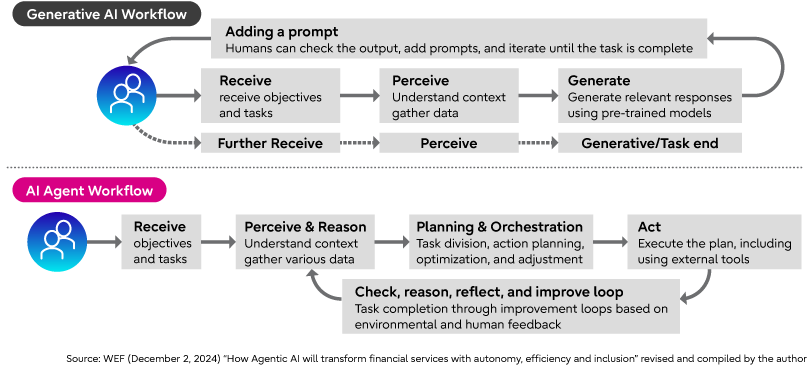

Figure 1 illustrates a conceptual diagram showing the differences in workflows between generative AI (LLM) and AI agents. With generative AI, humans are typically involved in the workflow, directly influencing the AI system's decisions and tasks. On the other hand, AI agents can autonomously complete the tasks assigned to them, with humans serving a supervisory role, intervening only when anomalies or unexpected situations arise. However, it’s important to understand that inference models like OpenAI-o1 can autonomously perform tasks that require multiple steps from a single prompt, making a direct comparison with AI agents difficult and highlighting that this is an evolutionary process.

Multi-Agent Systems (MAS)

The AI agents discussed so far are based on single-agent systems, which are designed to perform tasks or workflows for small teams or organizations. However, when it comes to complex workflows in larger organizations or ecosystems, single-agent systems have their limitations. This is because large-scale organizations and different domains require unique knowledge and workflows. To address this challenge, the concept of a "Multi-Agent System (MAS)" has been proposed.

MAS allows multiple agents to interact and share information, enabling them to handle tasks that span across multiple domains more efficiently. Additionally, through interactions between agents, collective intelligence and emergent solutions can be created, much like how humans collaborate.

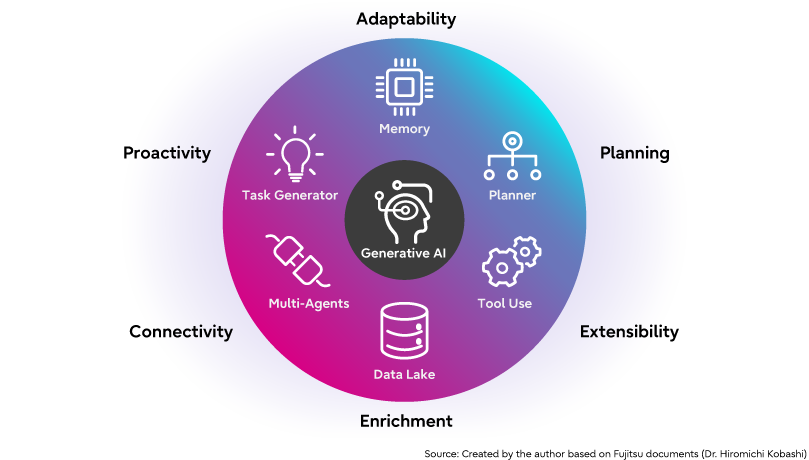

When a multi-agent system is viewed as a set of single functions or attributes (refer to Figure 2), the AI agents dynamically construct a system to achieve the given task and its goals. The main functions and attributes are as follows:

1)Planning: Systematically designing and coordinating the necessary actions or tasks to achieve the goal.

2)Scalability: The AI effectively leverages external tools and resources (such as databases, APIs, specific software, etc.) to expand its capabilities.

3)Enrichment: Utilizing diverse data in various contexts to gain insights from multiple perspectives.

4)Connectivity: Multiple AI agents collaborate, sharing information and dividing tasks to address complex problems and large-scale projects.

5)Proactivity: Deciding what task to take on next, solving non-obvious tasks, and expanding knowledge to help the agent grow.

6)Adaptability: Continuously updating by incorporating basic information and changes in dynamic data.

Extending and Resolving Issues with LLMs

In addition to the core functions of AI agents discussed earlier, LLMs can be extended and their issues mitigated by integrating memory mechanisms, accessing external tools and information sources, and interacting with the environment.

(1) Memory and Context Retention

While LLMs are stateless and do not remember past interactions, AI agents typically incorporate memory mechanisms, allowing them to store past interactions and maintain consistency and continuity over long-term engagement. By leveraging past context, agents can improve future responses and enhance the user experience.

(2) Enhanced Functionality through Asynchronous and Parallel Processing

LLMs process inputs synchronously and sequentially, but AI agents can handle multiple tasks simultaneously and operate asynchronously. This allows agents to manage real-time interactions more effectively, improving efficiency and responsiveness when handling multiple queries or tasks at once.

(3) Fact-Checking and Real-Time Information Access

AI agents can mitigate the "hallucination" problem and incorrect outputs of LLMs by performing real-time data validation and integrating with external tools (such as databases, web APIs, or the internet). This is particularly valuable in applications where up-to-date and accurate information is crucial. Furthermore, by interfacing with specialized mathematical engines or software, agents can perform precise mathematical calculations, which enhances their utility in technical and scientific fields.

2. AI Agents in Financial Services: Impact, Use Cases, and Early Adoptions

Today’s financial industry faces challenges such as difficulty in securing talent and decreased productivity due to frequent task switching, all within an environment of fierce competition. Financial institutions are not only seeking systems that can perform tasks but also ones that can analyze risks, predict market changes, and make accurate, risk-informed decisions. Autonomous AI agents, equipped with vast knowledge and high expertise, have the potential to turn these challenges into opportunities.

Benefits of Utilizing AI Agents

By implementing AI agents, financial institutions and market participants can enhance workflow optimization, improve customer experiences, drive innovation in services and business models, strengthen compliance, and improve decision-making, all of which can help them achieve a competitive edge.

The benefits of utilizing AI agents in the financial services industry can be summarized in the following four points:

1)Streamlining Operations By automating repetitive tasks such as data entry, compliance checks, and transaction processing, AI agents enhance productivity, reduce human errors, and enable employees to focus on more strategic tasks.

2)Enhancing Customer Interactions AI agents provide highly personalized experiences for customers. These agents help individuals manage their finances, make optimal decisions, and adjust strategies based on personal goals and risk levels, empowering users like never before.

3)Driving Innovation AI agents enable the creation of new financial tools, such as personalized robo-advisors and adaptive asset management systems, that can adjust strategies in real time based on market changes and customer preferences.

4)Improving Risk Management and Compliance AI agents enhance real-time risk assessments, monitor suspicious transactions, and dynamically respond to emerging threats and anomalies. They also streamline compliance by automating regulatory reporting and ensuring adherence to complex financial regulations.

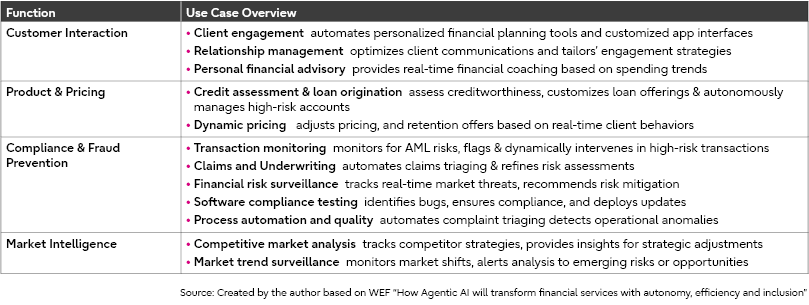

Use Cases of AI Agents in Financial Services

Financial services span multiple domains, including banking, insurance, securities, asset management, and credit card services. The development of AI agent use cases in these areas is progressing, with some use cases being applicable across multiple domains and others being specific to particular sectors. Table 1 below shows the primary use cases expected for four common functional areas across financial institutions.

Our research indicates that the use of generative AI in the financial industry is currently limited to specific tasks such as customer support and knowledge acquisition, leading to improvements in operational efficiency. However, its application to core business functions has been slow. This delay can be attributed to several factors, including technical challenges in implementing generative AI, inaccuracies in output caused by the model's hallucination issues, concerns about data security, and the difficulty of evaluating return on investment. However, the advantages of AI agents, such as memory retention, context awareness, enhanced asynchronous and parallel processing, fact-checking, and access to real-time information, can be leveraged to expand their use in core financial services operations.

Early Adoptions of AI Agents in Financial Services

AI agents are leading the digital transformation in the financial industry. Evolving from traditional rule-based AI to large language model (LLM)-based generative AI, they are at the forefront of change. While the financial sector is still in the learning phase, several early-use cases have been successfully implemented. Below are three such examples.

Moody’s – Financial Analysis Agent

Moody’s developed 35 agents, including specialized AI agents for tasks like project management, and integrated them into a "multi-agent system" where they collaborate with supervising agents(2). This system is used to analyze SEC filings and industry data, enhancing their research capabilities. The AI agents are specialized in specific tasks, and by having other agents verify the results, they can efficiently execute complex workflows.

Auquan – Financial Industry-Specific Digital Analyst

The automation of analyst tasks using AI agents is progressing. The startup Auquan developed an AI agent that specializes in creating financial industry reports, which is different from OpenAI's "Deep Research," designed for general purposes(3). For example, it collects and analyzes financial data (including unstructured data such as presentations and PDFs) and internet information to generate reports. This method is 80–90% cheaper and significantly more productive than manual report generation. Clients include MetLife, UBS, and Capital Group. Auquan has announced plans to extend its AI solutions to risk management, compliance, and sustainability workflows, and it is believed that these are now being implemented.

Capital One – Chat Concierge Agent

Capital One has introduced a chat concierge that uses multiple AI agents to comprehensively address customer inquiries related to car purchases(4). The concierge supports the entire purchase process, from vehicle comparison to test-drive reservations, easing the customer's burden. With a customized Llama AI-based model, it responds instantly to customer questions and can perform multiple tasks at once, such as providing trade-in estimates and setting appointments with sales representatives.

BNY– The Approach to Multi-Agent Systems

BNY has implemented a multi-agent system that includes 13 specialized agents, providing sales representatives with lead generation and recommendations through AI agents. The AI tool "Eliza" quickly understands client needs, improving sales efficiency, while multiple agents collaborate to produce the best outcomes(5). In addition, through a partnership with OpenAI, BNY is integrating new features into Eliza via an API, enabling the resolution of complex tasks and the acquisition of insights. By leveraging cutting-edge reasoning models and agent functions (Deep Research, Operator), BNY expects to enhance Eliza's accuracy and autonomy(6).

Summary

The use cases of AI agents in the financial industry, as demonstrated by the above examples, are currently limited to market trend intelligence analysis, extracting information from messy metadata, addressing complex customer needs, and managing compliance. However, the development of use cases and the evolution of related technologies are progressing steadily. For example, Fujitsu has developed technologies such as risk-response agents(7) and meeting agents(8), working with internal teams and financial institution clients to assess the impact of AI agents on operations and explore the optimal process for their implementation.

3. A Vision for the Future of Financial Services: Human-AI Agent Collaboration

Building on the discussions thus far, the evolution of AI’s natural language understanding is making human-machine interactions increasingly intuitive and flexible. Against this backdrop, we can envision a future where AI agents autonomously execute business processes, driving the transformation of financial services. However, the introduction of AI agent systems also brings potential challenges, such as an increase in systemic risks and volatility in financial markets, disruptions in the labor market, and the emergence of new security risks. Additionally, ethical and privacy concerns, as well as the opacity of outcomes resulting from autonomous decision-making, are important considerations. Therefore, it is essential to balance the pursuit of AI agent autonomy in financial services with addressing the challenges that arise from it.

In reality, the role of humans in financial services will need to be redefined in the age of AI agents. Specifically, the role of humans will shift from being "operators" of daily tasks to "orchestrators" who oversee and adjust AI systems. Humans will monitor the progress of business operations and intervene or adjust when necessary. As advancements are made in areas like improved reasoning abilities, hallucination mitigation, and the reduction of ethical and privacy risks, human intervention will gradually become minimal. Furthermore, humans are expected to focus more on creative tasks that leverage their emotional intelligence, cognitive skills, and physical dexterity, working in collaboration with AI to expand these capabilities.

The rapid innovation of AI agent technology requires the financial services industry to set value-driven goals, enhance the necessary skills and capabilities, and establish a robust governance framework that includes change management and risk management. By making these preparations, we can realize a future in which humans and AI agents work together to shape the financial services of tomorrow.

References

- Jinamin Jin (March 2025) “Pushing the boundaries of Generative Tech: AI agent innovates”

-

Moody’s (2024) “GenAI’s transformative potential in the financial sector: the evolution of agents”

Ari Lehavi et al. (2024) “The rise of the digital colleague: evaluating companies with Moody's AI agents” - Auquan(Jan 14, 2025)“Auquan Enters 2025 with Breakthrough AI Innovations and Financial Services Impact”

- Jocelyn Mintz (January 31, 2025) “Capital One’s new AI agent will help you buy your next car”

- Emilia David (February 25, 2025) “How big U.S. bank BNY manages armies of AI agents”

- Isabelle Bousquette (February 26, 2025) “BNY, America’s Oldest Bank, Signs Multiyear Deal With OpenAI”

- Fujitsu Press Release (December 2024) “Fujitsu develops world’s first multi-AI agent security technology to protect against vulnerabilities and new threats”

- Fujitsu Press Release (October 2024) “Fujitsu to offer AI agents that can both collaborate and engage in high-level tasks autonomously”

Dr. Jianmin Jin (Ph.D in International Economic Law)

Chief Digital Economist Fujitsu Ltd.

Senior Director

Global Marketing Unit

2020 Fujitsu Ltd., Chief Digital Economist. 1998 Fujitsu Research Institute, Senior Fellow.

Dr. Jin's research mainly focuses on global economic, digital innovation/digital transformation, and Dr. Jin has published books such as ”Towards the Creation of a Japan’s Silicon Valley”(2020), etc.

Related Information

Pushing the boundaries of Generative Tech: AI agent innovates

Designing the Next Generation of Intelligent Manufacturing with Generative AI

Innovative Banking with Generative AI