PRESS RELEASE

Fujitsu and Sony Bank partner to integrate generative AI into core banking system design and development

Initiative targets AI-driven system design, 20% faster development, and enhanced service delivery for all core banking functions by April 2026

Fujitsu Limited

Sony Bank, Inc.

Kawasaki and Tokyo, Japan, October 6, 2025

Fujitsu Limited and Sony Bank, Inc. today announced that generative AI has been integrated into the system development for Sony Bank's new core banking system, which leverages Fujitsu's core banking solution, from September this year.

In May 2025, Sony Bank successfully achieved a full cloud shift for all its systems with the implementation of a cloud-native core banking system powered by Fujitsu's core banking solution. This shift significantly enhanced the flexibility and scalability of Sony Bank’s banking systems and overall operations.

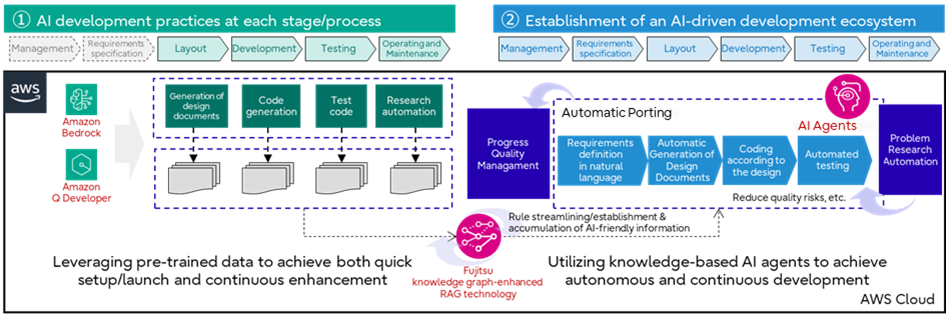

This initiative marks the initial phase of establishing an AI-driven development ecosystem, leveraging generative AI within Sony Bank’s cloud-native environment. By April 2026, both companies plan to apply generative AI across all Sony Bank core banking system development projects, aiming to establish an advanced AI utilization model for Japan's financial industry.

Tatsuya Fukushima, Corporation Executive Officer, Sony Bank, comments:

"Our goal is to deliver new value to our customers through technological innovation. We are excited to embark on this collaboration with Fujitsu, integrating generative AI into our core banking system development. This partnership isn't just about efficiency and quality; it's about unlocking more flexible and agile services for our customers. Merging our cloud-native environment with cutting-edge AI marks a significant leap forward in redefining the future of financial services."

Masaru Yagi, Corporate Executive Officer, SEVP, Fujitsu Limited, comments:

"Building on the successful delivery of the next-generation digital banking system in May, Fujitsu is proud to partner with Sony Bank on a strategic initiative that will apply generative AI to innovate system development. This undertaking marks the official launch of our vision for a truly AI-driven development ecosystem, centered on generative AI. By integrating Fujitsu's AI expertise and business knowledge into Sony Bank's operational core banking solution, we expect to significantly accelerate their development and service delivery."

Overview of the Initiative

First, Sony Bank and Fujitsu will apply generative AI to the development and testing phases of core banking systems. The partners will leverage Fujitsu's proprietary knowledge graph-enhanced RAG technology, which refines generative AI input data by linking large dataset relationships, to improve AI accuracy. Future plans include expanding consistent generative AI-driven development across all processes – from management and requirements definition to operation and maintenance – with an expected 20% reduction in development times. By completing all processes entirely on AWS, the initiative will achieve advanced scalability, security, and significantly enhanced development efficiency. This will foster a robust development ecosystem through the maximization of Fujitsu's core banking solution benefits and AWS integration for continuous quality improvement and rapid development cycles.

Future plans

Moving forward, Sony Bank will fully leverage the cloud-native characteristics of its new core banking system to accelerate development efficiency, enhance quality, and swiftly deliver new products and services by integrating various external services and adopting new technologies.

Through the provision of its core banking solution, Fujitsu will continue to promote its financial industry-focused initiatives with Uvance. In this way, Fujitsu aims to enhance business operations for financial institutions and contribute to the realization of a more prosperous society.

Press Contacts

Fujitsu Limited

Public and Investor Relations Division

Sony Bank, Inc.

All company or product names mentioned herein are trademarks or registered trademarks of their respective owners. Information provided in this press release is accurate at time of publication and is subject to change without advance notice.

Date: 6 October , 2025

City: Kawasaki and Tokyo, Japan

Company: Fujitsu Limited, Sony Bank, Inc.